As the UAE corporate taxation landscape evolves, knowing which expenses are deductible—and the particular conditions that apply—is essential to efficient tax planning. The difference between deductible and non-deductible expenses can greatly impact your company’s tax obligation.

Accurate estimation of deductions of expenditures will result in tax minimization, optimization of financial performance, and compliance.

In this blog, we will look at the key deductible and non-deductible expenses under the UAE Corporate Tax Law, the conditions for deductibility, and best practices for companies to maximize tax benefits while ensuring compliance.

Key Takeaways

- Knowing deductible and non-deductible expenses helps businesses in the UAE reduce tax liability and stay compliant.

- Deductible costs include rent, salaries, and marketing, while non-deductible ones cover fines, capital expenses, and corporate taxes.

- Maximizing deductions requires accurate records, proper expense allocation, and expert tax guidance.

What Are Deductible Expenses?

Businesses can claim tax deductions for particular expenses that are incurred in order to run and maintain the company’s business. Depending on where the business is located, there may be various tax deductions.

Tax deductions have several uses and are quite valuable for a corporation. They serve multiple purposes:

Minimizing tax liability:

By lowering taxable income, deductions directly reduce the amount of tax that a firm must pay.

Promoting specific behaviours:

Through deductions, the government can encourage companies to take part in initiatives that are thought to be beneficial to the economy or society.

Representing true profitability

Deductible expenses portray a more accurate representation of a company’s financial health by taking into consideration necessary expenses.

Promoting fairness:

By deducting legitimate business costs, the tax system seeks to tax only the actual revenue generated.

Types of deductible expenses in corporate tax

A list of business expenses that are usually deductible to lower the organization’s taxes is provided below:

Operating Costs

- Rent: The cost of renting an office or warehouse, including upkeep costs for the business space.

- Utilities: Costs associated with running a business, such as internet, water, and power.

- Salaries and Wages: Payments made to workers, such as bonuses and other incentives.

- Employee Training: Expenses related to enhancing workers’ skills to boost productivity.

- Supplies: The price of buying goods or resources that are used directly in business operations.

Interest Expenses

The UAE corporate tax law enables interest to be deducted from taxable earnings, but it is liable to certain limitations. There are particular regulations for interest deductions to avoid base erosion and profit shifting (BEPS) via excessive debt financing.

Expenses for deductible interest could include:

- Business loan interest

- Interest paid on business-related credit lines or overdrafts

- Finance fees for financial leases

- The interest part of Islamic finance plans

It’s important to remember, though, that the general and particular interest restriction rules determine whether or not interest is deductible.

Charitable Contributions

The CT Law defines that only contributions to qualifying public benefit organizations are deductible, making sure only donations serving the public good and related to the company’s objective are considered for tax relief.

Entertainment Expenditure

Only 50% of the expenses can be deducted for entertainment expenses, such as lunches or gatherings for clients or business associates.

For example, if a business spends AED 100,000 on entertaining customers, only AED 50,000 is tax-deductible. However, if the cost is for staff amusement (e.g., a company party), it can be fully tax-deductible, unless the event is personal in nature (e.g., a wedding ceremony).

Depreciation of Assets

Companies can deduct depreciation costs for fixed assets like vehicles, machinery, and office supplies based on prescribed accounting methods.

Marketing and Advertising Costs

Expenses related to branding, marketing, and advertising expenditures are deductible if they are associated with the business.

Legal and Professional Fees

For business-related services, payments to tax advisors, consultants, auditors, and attorneys are deductible.

Conditions for Deductibility

1.Expenditure Must Be Solely for Business

For expenses to be deductible, they must be incurred exclusively for the purpose of making revenue or carrying out commercial operations. Claims cannot be made for personal costs or expenses unrelated to business operations.

2. Timing of Expenses

Expenses must be reported within the fiscal year in which they are incurred. Companies should match their accounting periods with their spending claims to prevent problems during audits.

3. Apportioning Mixed Expenditures

Businesses must divide expenses if they are partially for non-business and partially for company use. The only part that is deductible is the part that is directly tied to producing taxable income.

Example: If a company pays office rent and uses a portion of the space for personal use, only the portion that is relevant to business operations is deductible.

4. Expenses Must Not Be Capital in Nature

Capital expenditures cannot be deducted from expenses. Typically, capital expenditures entail sizable investments in assets that yield long-term gains (e.g., purchasing property or machinery). Rather, the operating costs incurred within a fiscal year should be subject to deductible expenses.

5. Expenses Must Be Properly Documented

Supporting claims for deductible expenses requires accurate documentation. Companies should keep:

- Invoices and receipts that identify the nature of the expenditure.

- Documents detailing how each expenditure relates to company activities.

- Financial statements that accurately reflect these transactions with precise accounting entries.

What Are Non-Deductible Expenses?

Non-deductible expenses are business costs that cannot be subtracted from a company’s taxable income when calculating its corporate tax liability. These are essentially expenditures that companies are not permitted to deduct under UAE tax legislation, even if they are directly related to the daily activities of the company.

The primary difference of non-deductible expenses is that they are not directly related to the development of company revenue or are considered outside the boundaries of what the tax authorities consider eligible for deduction. Although businesses may incur these costs during operations, they cannot be claimed to reduce taxable income on tax returns.

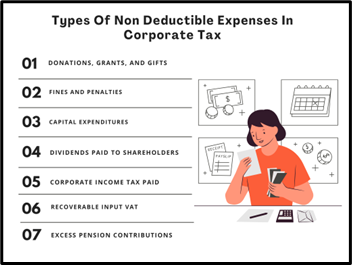

Types of nondeductible expenses in corporate tax

Donations, Grants, and Gifts

Not all charitable contributions are deductible under UAE corporate tax legislation, even though they can improve a company’s reputation. Donations are only deductible to certain public benefit organizations.

Fines And Penalties

It is not possible to deduct penalties and fines for legal violations or regulatory non-compliance from taxable income. This comprises fines for late filing, regulatory violations, and other forms of noncompliance, excluding funds given as compensation for losses or contract breaches.

Capital Expenditures

Investments made to purchase new assets—like real estate, buildings, or large machinery—are regarded as capital expenditures and cannot be written off as ordinary expenses. However, they may lose value with time.

Dividends Paid to Shareholders

Payments of dividends to shareholders are not deductible since they are not regarded as company expenses.

Corporate Income Tax Paid

Payments of corporate taxes to the UAE government are not considered deductible expenses.

Recoverable Input VAT

Under the UAE Corporate Tax framework, a business’s recoverable VAT payments are not deductible. Companies are required to make sure that VAT paid on non-deductible expenses is accurately recorded.

Excess Pension Contributions

Employers are not allowed to deduct payments to private pension funds that exceed 15% of an employee’s total compensation or that were not made within the applicable tax period.

How companies can maximize deductions

Entertainment Expenses

Deductions should only be claimed for entertainment expenses that directly benefit customers and are associated with business operations. Keep employee-related costs apart from client entertainment.

Apportion Mixed Expenditures

Establish a mechanism to precisely track and distinguish between expenses for personal and commercial use (such as mileage records for vehicles) to guarantee correct deduction.

Depreciation on Capital Expenditures

Make accurate asset classifications and use the right depreciation techniques. Organise purchases to maximize deductions in the future. If possible look for accelerated depreciation alternatives.

Tax Professional Consultation

In the UAE, lowering taxable income requires consulting with a tax expert. Tax professionals can offer tailored guidance on tax planning techniques, guaranteeing that people and companies utilize all available credits and deductions.

Record-Keeping

Maintaining accurate records or well-managed documentation will facilitate tax audits and assist in the validation of deduction claims. Accurate documentation of expenses is particularly useful in compliance procedures as well as the appropriate management of resources.

Carry Forward Deductions

Keep track of unused deductions, such as interest or depreciation, and, if you can, transfer them over to subsequent years.

Final thoughts

Knowing allowable expenses under UAE’s Corporate Tax and VAT regimes is important for ensuring tax compliance and minimizing tax liabilities. Collaborating with qualified tax experts can provide insightful information and guarantee that your corporation’s tax plan complies with regulatory criteria and company objectives.

By keeping up with the latest corporate tax law updates and adopting strong expense management systems, companies can optimize their deductions and enhance their financial strategy.