Many business and company owners don’t know about the UAE Corporate tax exemption.

With the implementation of Corporate Tax in June 2023, companies need to understand who needs to register for UAE Corporate Tax. All legal entities, including mainland and free zone businesses, international firms doing business in the United Arab Emirates, and natural persons, such as freelancers, with yearly incomes above AED 1 million are required to register.

The UAE’s corporate tax structure seeks to strike a balance between fostering economic development and adhering to global tax standards. By providing tax exemptions for certain entities and operations the UAE ensures companies remain competitive while contributing to the nation’s economy.

This guide explains the benefits of corporate tax exemptions, who qualifies for them, and the main rules companies must follow to successfully navigate this changing tax system.

With the implementation of Corporate Tax in June 2023, companies need to understand who needs to register for UAE Corporate Tax. All legal entities, including mainland and free zone businesses, international firms doing business in the United Arab Emirates, and natural persons, such as freelancers, with yearly incomes above AED 1 million are required to register.

The UAE’s corporate tax structure seeks to strike a balance between fostering economic development and adhering to global tax standards. By providing tax exemptions for certain entities and operations the UAE ensures companies remain competitive while contributing to the nation’s economy.

This guide explains the benefits of corporate tax exemptions, who qualifies for them, and the main rules companies must follow to successfully navigate this changing tax system.

Benefits of Corporate Tax Exemption in UAE

Cost Savings for Businesses

Tax exemptions reduce a company’s financial burden, allowing profits to be reinvested in expansions, innovations, or growth.

Employment Opportunities

Businesses create jobs across a range of industries as they grow and reduce expenses.

International Investment

Tax exemptions draw in foreign companies, boost the local economy, and foster international partnerships.

Lower Operating Costs

Exemptions minimize overall costs, allowing companies to allocate additional funds toward growth and development.

A Lifeline for Startups

Tax breaks allow young businesses to thrive and expand in fiercely competitive marketplaces.

Stand out in Competitive Markets

With fewer expenses, companies can end up providing lower prices and a competitive advantage in the marketplace

Eligibility Criteria for Corporate Tax in the UAE

In Dubai, United Arab Emirates, taxable income up to AED 375,000 is exempt from corporate tax.

- For income over AED 375,000, the corporate tax rate in the United Arab Emirates is 9%.

- A 15% corporate tax rate will apply to multinational firms that are governed by OECD Base Erosion and Profit-Sharing regulations and are included in Pillar 2 of the BEPS 2.0 framework. This is applicable to businesses who generate more than AED 3.15 billion in total worldwide revenue.

Taxable Entities in the UAE

Following are the variety of entities and individuals involved in financial activities, categorized as resident and non-resident persons for whom the the UAE corporate tax framework applies:

Resident Persons:

- These are the legal entities established, registered, or recognized in the UAE, as well as foreign entities that operate within the UAE.

- Individuals conducting business or industrial activities within the UAE also fall in this category.

Non-Resident Persons:

- Non-resident entities or individuals with a permanent establishment in the UAE, income generated from sources within the UAE, or connections established by Cabinet decision are considered taxable.

- Branches of non-resident entities are treated as the same taxable person for corporate tax purposes.

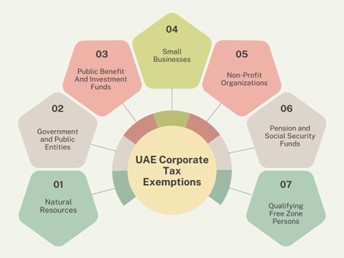

UAE Corporate Tax Exemptions

Several groups of organizations and income streams are exempt from UAE corporate tax, enabling businesses to organize their business operations to optimize tax liabilities.

Natural Resources

Companies involved in gathering natural resources, like natural gas and oil, remain liable for Emirate-level taxes rather than government corporate tax.

Government and Public Entities

Corporate tax exemptions apply to the federal and emirate governments of the United Arab Emirates as well as its ministries.

Public Benefit And Investment Funds

Certain qualifying public benefit organizations and investment funds may also be exempt, given they meet certain criteria under the Corporate Tax Law.

Small Businesses

Small businesses satisfying particular revenue criteria can apply for a 0% corporate tax rate, decreasing their tax burden and supporting their growth.

Non-Profit Organizations

Charitable organizations that provide medical care, educational programs, or similar offerings toward public welfare can be exempted if they file and the exemption is granted on their application.

Pension and Social Security Funds

Public and private pension and social security companies are exempted from corporate tax.

Qualifying Free Zone Persons

A taxable person may be eligible for the 0% corporation tax rate on their qualifying income if they satisfy the requirements to be considered a Qualifying Free Zone Person (QFZP).

To be qualified, an organization must:

- Keep a free zone in the United Arab Emirates with sufficient substance.

- Obtain qualified income

- Follow the documentation requirements and transfer price guidelines.

- Create audited financial records in compliance with the IFRS

- Have non-qualifying income that is below the de-minimis threshold.

Qualifying income includes two main types:

- Type 1: Revenue from transactions with individuals in the free zone: This type of income is derived via dealings with other individuals in the free zone, unless it does not come from excluded activities.

- Revenue from transactions with individuals who are not in the free zone (qualifying activities): Income produced by engaging in qualifying activities with entities outside the free zone can also be regarded as qualifying income, unless it does not come from excluded activities.

Corporate Tax Deadlines and Penalties

1. Deadlines According to License Issuance:

Businesses must register by certain deadlines based on the issuance date of their commercial licenses. The important deadlines for 2024 are:

- For licenses issued in January–February: Register by May 31, 2024.

- For licenses issued in March–April: Register by June 30, 2024.

- For licenses issued in May: Register by July 31, 2024.

2. Late Registration Penalties

AED 10,000 is the penalty for not registering by the deadlines. Furthermore, persistent non-compliance may result in fines, legal action, and reputational damage.

Financial records required for Corporate Tax

Companies in the UAE should ensure corporate tax adherence by maintaining financial and other documents that demonstrate the information stated in the corporate tax return. Such documents should also be filed to the Federal Tax Authority. (FTA). Entities exempt from UAE corporate tax are required to maintain records to allow the FTA to verify their exempt status.

Companies wishing to file for corporate tax in the United Arab Emirates must be ready to provide the required paperwork. Business tax registration and payment will be completed online. In the UAE, corporate tax registration may also require the following documents.

- Copies of the Trade License (must be valid).

- Photocopy of the passport of the license owner/partners (must be valid).

- Emirates ID of the license owner/partners (must be valid).

- Power of Attorney (or Memorandum of Association).

- Contact details (Mobile Number and Email).

- Company contact information (full address and P.O. Box).

- Annual Financial Audit Report.

It is also important to know that for the purpose of UAE Corporate Tax, a group of businesses can be elected to create a tax group and can be handled as a single taxable individual, provided that certain criteria are met. A tax group in the UAE will only have to file one tax return for the group as a whole. Additionally, foreign investors would be entitled to claim a tax credit against their UAE corporation tax liability for foreign corporate tax paid on UAE taxable revenue.

Filing of UAE corporate tax

After UAE business registration, firms have to prepare for their first corporate tax submission, due within nine months after the end of their pertinent tax period. Within this period, any UAE corporation tax that is due must also be paid.

The first taxable period will be from January 1, 2024, to December 31, 2024, since the majority of businesses have fiscal years that end on December 31. This establishes September 30, 2025, as the filing date for the first company tax return in the UAE.

Companies have to keep all relevant documents and records for seven years following the end of the tax year to which they relate. This is essential for maintaining adherence to UAE tax laws and making any upcoming audits easier.

How Accurate Helps you to get UAE corporate tax exemptions

Knowing the company tax laws and regulations of the UAE will assist businesses in adhering to the taxation procedures used by the government. This additionally lets you determine instances in which you are legally exempt from paying 9% or 15% tax on the income.

If you are not certain about the tax laws and regulations of the UAE but you still wish to start your own business then you can seek help from legal consultants, tax professionals, and accounting firms. This will assist you in adhering to all rules and guidelines established by the FTA and the UAE Ministry of Finance.