Hiring an Indian Chartered Accountatns in Abu Dhabi can bring a new twist to your organization and make business proceedings easier.

Selecting an accounting professional in Abu Dhabi is a crucial choice because the accounting department is one of the main divisions of any company and contains important information about the organization of the company.

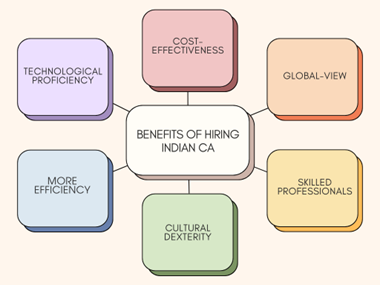

Indian Chartered Accountants also provide companies with strong technical knowledge, affordable services, familiarity with international financial standards, and deep expertise in taxation and compliance, making them efficient in handling diverse financial requirements.

This blog’ll discuss the benefits, how to find, and what to consider when choosing an Indian CA.

Key Takeaways

- Indian Chartered Accountants in Abu Dhabi provide cost-effective services, strong technical expertise, and knowledge of international financial standards, making them valuable for businesses.

- Hiring the right CA involves defining financial needs, using job portals and networks, and evaluating candidates based on skills, experience, and technological proficiency.

- Key factors in selection include reputation, industry affiliations, service quality, and client rapport, ensuring long-term business success.

Benefits of hiring Indian Chartered Accountants in Abu Dhabi

Cost-effectiveness

If you want a remote accountant, outsourcing your financial tasks to a remote Chartered Accountant (CA) in India can help you save a lot of money. Since the cost of recruiting remote accountants in India is considerably lower than in the United States, Canada, and Mexico, your company could benefit from lower overhead expenses, including wages, employee benefits, and workspace.

Global-View

There is a growing interdependence in the economic world. Your staff will gain a deeper understanding of worldwide accounting processes by hiring Indian accountants, who offer a distinct global perspective. This might be especially helpful if your company has many locations or services with a diversified clientele.

Skilled professionals

Indian Chartered Accountants (CAs) are among the many highly qualified and skilled accounting professionals. According to Statista research, the nation boasts a robust educational system that produces skilled experts in worldwide accounting standards and procedures.

Cultural Dexterity

Indian professionals are well known for their meticulous attention to detail, strong work ethic, and cultural awareness. This allows them to easily fit into various teams and successfully communicate with customers across backgrounds, promoting a more cohesive and productive working environment.

More efficiency

Another major advantage of Indian CA is increased efficiency. Indian accounting professionals are known for their expertise, which can free up your time to concentrate on other aspects of managing your business. They often know more about recent accounting procedures and software. As a result, they can assist with streamlining your business processes and make your overall accounting procedure more efficient.

Technological Proficiency

Indian Chartered Accountants (CAs) are proficient at using modern accounting platforms like QuickBooks, and Xero, that lets them manage finances more effectively and accurately. Their familiarity with these technologies speeds up and reduces the likelihood of errors in processes like bookkeeping, tax filing, and financial reporting.

Also, many Indian CAs are skilled in new technologies like AI and blockchain, which allow them to provide creative approaches and keep businesses up to date with changing rules and regulations. This makes them an excellent option for businesses looking to enhance their financial management.

How to hire Indian Chartered Accountants in Abu Dhabi

Evaluate Business Requirements

The first step is to lay out your requirements for the CA position. Start by thinking about the precise abilities, credentials, and degrees of experience you’re seeking.

Assess whether you need a CA with skills in audit, taxation, financial reporting, or any other specific field relevant to your industry.

Consider the following questions, to assist you in determining your requirements:

- Why do you require a CA?

- What duties and obligations will they have to carry out?

- Would a part-time CA would suffice, or do you need a full-time one?

- Do you need one or more certified public accountants? Should you consider working with a CA firm?

- Does your budget match the current rates in the market?

Advertise on the Right Platforms

When it comes to CA jobs, it is crucial to advertise the opportunity so that it reaches the right people. Using job portals that specialize in accounting and finance roles can help you find the best applicants.

- Popular Job Platforms: If you’re an employer, post an open position on Indeed, LinkedIn, and various other traditional boards.

- CA Networks: Get in touch with other CA-affiliated organizations, such ICAI, which also posts employment openings on its own lists.

Leverage Social Networks

The greatest source of professional referrals is social media. You can look for a trustworthy accountant by using your social networks.

When looking for an accounting professional, the best choice may be right in front of your eyes. Begin by asking any small-business-owning companions or family members if they would recommend any Indian accountant.

Keep in mind that choosing an accountant is a personal choice; what suits your best friend’s public relations agency may not suit your manufacturing company. Therefore, conduct some research to find out what services the accountant offers, how much experience he has in the industry, client testimonials, etc.

Assess and shortlist candidates

Once you’ve received applications, it’s time to go through them and shortlist those who align with your company’s needs. Seek applicants with a strong grasp of financial reporting and accounting principles, as well as proficiency in tax preparation and filing.

Strong auditing skills, financial data analysis, and problem-solving ability are essential. Candidates should also have outstanding communication skills, especially active listening, to make sure they comprehend and can handle the financial needs of your company.

Conduct Interview

After shortlisting the applicants, you should carry out interviews to delve deeper into the applicants’ qualifications, abilities, professional objectives, and alignment with the business’s vision.

You must include finance interview questions to verify candidates’ qualifications, work experience, and professional credibility.

To assist you in selecting the best applicant, consider the following interview questions:

- Describe an intricate tax issue you recently experienced and how you resolved it.

- How much experience do you have planning taxes for various kinds of businesses?

- How do you manage situations where you identify possible fraud or misstatements?

- Can you walk me through your procedure for discovering and dealing with accounting errors?

- Explain a difficult financial issue you encountered in a prior position and how you resolved it.

- Describe a situation where you had to use your creativity to come up with an innovative approach.

Choose One That Fits Your Budget & Needs

Hiring chartered accountants in Dubai is, in fact, one of the most crucial business decisions you can make. So, when it comes to selecting an accountant, many individuals choose the most affordable choice. At first glance, this could seem like an excellent concept, but cheap services are frequently not worth the cost.

Finding an accountant that fits your goals and budget is crucial since the top accountants will offer more value than their less expensive alternatives. Once the budget is decided, make an agreement letter with the accountant.

Important factors to consider before selecting a CA in Abu Dhabi

Check for Industry Associations

Chartered accountants who are members of industry organizations can offer you valuable resources and insights. These associations frequently offer training, networking opportunities, and access to the most recent industry trends and news. You can check if the accounting professional is a member of industry associations such as the ICAEW or the DICPA.

Good rapport with clients

The company and the Chartered Accountant need to have an excellent personal connection throughout their business relationship. A solid working relationship with one’s accounting professional is essential for a business to expand.

Quality of service

Business owners need to have extensive knowledge of the services provided by the CA in the UAE. Businesses can hire specialists on a full-time or part-time basis to handle accounting services. If you need an entire set of accounting processes, then full-time accounting professionals are recommended.

Reputation

When selecting an Indian CA in Abu Dhabi, reputation is a crucial consideration. You can assess their reputation, by reviewing evaluations on the accountant’s website, social media accounts, or independent review websites. To find out more about the accountant’s experience working with their current clients, you can also ask them for recommendations. An accountant with a solid reputation is reliable, and competent, and offers their clients high-quality services.

Get Best Indian Chartered Accountants Service in Abu Dhabi fro Accurate Accounting Solutions

Selecting the right Indian CA is more than just a financial decision—it’s an investment in your company’s future. Accurate Accounting Solutions Provides the best Indian Chartered Accountants Service in Abu Dhabi.

Hiring an Indian accounting professional in Abu Dhabi is a successful strategy to improve organizational efficiency. Employing them will help to enhance operations and boost revenues by facilitating remote work, enhancing data management, and producing more accurate reporting.

By carefully considering these important factors, you can find an Indian chartered accounting that will contribute significantly to the long-term success and financial stability of your company.