Late or non-payment of corporate Tax in the UAE can result in hefty penalties and unwanted complications.

This blog post will guide you in avoiding late or non-payment of UAE corporate tax.

We’ll check into the tax rates you need to know, the importance of staying informed about the tax laws, and when to seek professional advice to ensure your business remains compliant.

Let’s explore l the complexities together and pave the way for smooth tax filing in the UAE

What is corporate tax?

Corporate tax, often known as corporate income tax or company profits tax, is a direct tax imposed on organizations and businesses’ net income.

By incorporating this tax system, the UAE has joined many nations worldwide that have already implemented corporate tax systems.

On December 9, 2022, the Corporate Tax Law was issued, which established the legal framework for implementing and introducing a corporate tax effective for financial years starting on or after June 1, 2023.

Taxable income beyond AED 375,000 is subject to a 9% statutory tax rate unless exempted. Income below this amount is not taxed.

What kinds of incomes or enterprises are exempt from corporate tax?

As mentioned, companies exceeding the 3,75,000 AED profit should pay corporate tax.

But, there are specific types of income or business that are exempt from the corporate tax

Below mentioned are the following businesses or their income that are exempt from corporate tax:

- Corporate taxes will not apply to individuals, to income received from employment, real estate, investments in shares, or any other source of personal income that isn’t connected to a business or trade in the United Arab Emirates.

- Foreign investors who don’t do operations in the UAE are exempt. The current corporate tax benefits granted to free zone enterprises that adhere to all regulatory requirements would be continued.

- Businesses in the UAE are exempt from taxes on capital gains and dividends obtained from eligible shareholdings. However, this exemption does not apply to qualifying intragroup transactions and restructurings.

Corporate tax in UAE Free Zones

Starting June 1, 2023, UAE firms will be subject to a new tax regime. Nevertheless, individuals who operate within a free zone entity will benefit from this.

They will not be required to pay corporate tax on their eligible income.

Furthermore, you may relax knowing that this new tax won’t affect your income—including your salary—until you meet the qualifying income threshold. This includes savings and real estate assets.

Also, suppose you want to understand complex tax systems.

In that case, you can take advantage of professionals who can assist you with all the details, where you can learn more about qualifying income or how to structure your business for maximum tax savings.

If you establish an offshore business in a free zone, you will be considered similar to any other free zone business.

To qualify, you must divide your property portfolio into two categories: inside and outside the free zone.

You don’t have to pay taxes if you’re making money from other companies operating in the free zone.

Residential places like hotels or serviced apartments are exempt from this; it only applies to commercial properties like shops and offices.

However, a 9% tax will be applied to any transactions you make with people outside the free zone or with anything in the second category. It applies to all, irrespective of their status.

Who will be subject to corporate income tax in the UAE?

The UAE’s business tax rate is determined by the following criteria:

- 0% tax applies between AED 0 and AED 375,000.

- 9% tax applies above 375,000

Businesses operating in the United Arab Emirates may be required to pay a 9% tax up to a government-set threshold. The Ministry of Finance is in charge of determining the tax rates.

A separate tax rate may apply to large multinational firms that meet specific criteria under the OECD Base Erosion and Profit Shifting Project, Pillar Two.

Corporate tax will be imposed on the accounting net profit disclosed in the company’s financial statements.

There are a few modifications and exclusions, though.

You can carry all your tax losses from corporate tax inclusion to future years and use them to reduce your taxable income.

Thus, in terms of earnings, companies will pay corporate tax on their adjusted accounting net profit.

Criteria | Details |

Profits up to AED 375,000 | Taxed at 0% |

Profits above AED 375,000 | Taxed at 9% |

MNEs with global revenues over AED 3.15 billion | Subject to OECD rules |

Until Pillar 2 rules were adopted | MNEs were taxed under the regular UAE regime |

Taxable profits | Based on adjustments in accounting profits |

Steps to File Corporate Tax in the UAE

Step 1: Determine the eligibility for corporate tax registration

The first civil stage in the business tax registration process is determining if an individual must pay business taxes in the UAE.

Step 2: Apply for tax Registration number (TRN)

Initially, to register for corporate tax in the United Arab Emirates, one must apply for a tax registration number or TRN.

This number is specific to your company and is required to complete any tax-related transactions in this region. It is advisable to go through the official Federal Tax Authority (FTA) online application process to apply for a TRN.

Step 3: Gather the required documents for registration

Once a TRN has been received, the next step is to collect and gather the documents needed to complete the process.

Step 4: Prepare and file a tax return

Obtain the correct corporate tax return form from the FTA. Fill out the tax return form with all required financial details. File the completed tax return form through the FTA’s e-services portal by the due date.

UAE’s Corporate Tax Penalties & Fines

The UAE’s Ministry of Finance and Federal Tax Authority have declared a number of corporate tax fines and penalties. A taxable person is subject to penalties and fines if they break laws or neglect to file the corporate tax return on time.

Below mentioned is the list of such fines and penalties:

- AED 10000 – Late Corporate Taxation Registration fines

- Also, AED 1,000 is charged for each late submission, and this penalty is increased by AED 1,000 per month for a maximum of AED 10,000.

Late Corporate Tax Return Submission fine:

- In the first twelve months: AED 500 monthly

- From the thirteenth month onwards: AED 1,000 monthly

Failure to maintain up-to-date records and information as corporate tax law can result in significant penalties. Each infraction incurs a fine of AED 10,000 and repeated offences within twenty-four months of the initial violation result in fines of AED 20,000.

For unpaid corporate tax, a fine of 14% per annum is applied monthly from the day after the due date of payment.

The deadlines for payments following voluntary disclosure submissions are 20 business days from submission and 20 working days from receipt for tax assessments.

In cases where you cannot facilitate the tax auditor during an audit, a fine of AED 20,000 will be imposed. Incorrect corporate tax return submissions incur a fine of AED 500 unless corrected before the deadline stipulated by corporate tax law.

Late payments of corporate tax declarations to the relevant authority attract fines of AED 500 per month for the first 12 months and AED 1,000 per month thereafter.

If you fail to submit required documents, records, or data in Arabic when requested, a fine of AED 5,000 will be imposed.

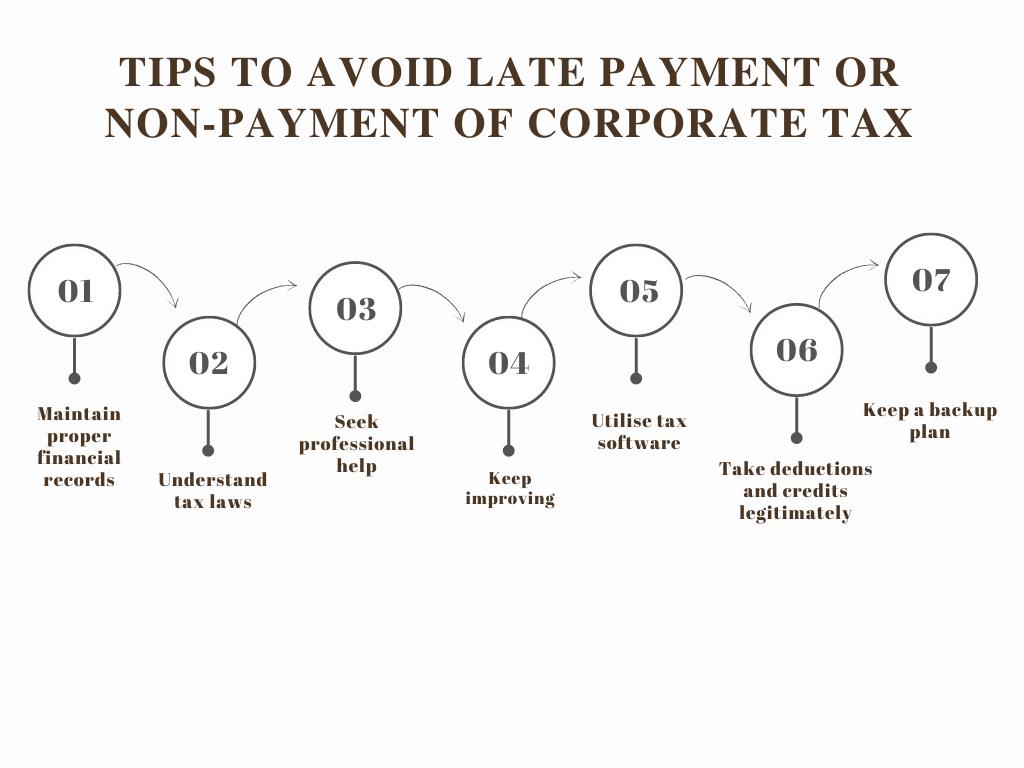

Tips to avoid late payment or non-payment of corporate tax

Maintain proper financial records

Keeping accurate financial records facilitates claiming deductions for business expenses, which can reduce a company’s taxable revenue and, ultimately, its corporation tax obligation.

Additionally, proper financial records ease the stress and difficulty of audits. Accurate documentation will assist you in demonstrating that you have complied with all relevant rules and regulations if the authorities or another regulatory body ever audits your firm.

Understand tax laws

Learn about the tax rules that apply to you and your circumstances.

Tax regulations might be complicated and differ depending on unique circumstances.

So make sure to have a basic tax knowledge.

Seek professional help

Hiring tax professionals to help with your complex tax position can be very beneficial, especially if you own many homes or operate a business.

Expert teams in tax accounting can offer advice, ensure your taxes are submitted on time and accurately, and guide you through any complicated tax rules or regulations that might be relevant to your particular case.

Keep improving

Reviewing and refining your tax filing procedure is the last step.

You must assess your tax filing process, pinpoint any difficulties, and absorb any lessons from your errors. It’s also important to recognize the way you filed your tax return correctly. For instance, you can review your tax filing documents, decide what you did well and where you can improve, and use the lessons you learned in your next filing.

Utilise tax software

Consider using tax preparation software specifically designed to comply with UAE tax regulations.

These software solutions can streamline the tax filing process, making it more efficient and less prone to human error.

Tax software often includes features like automated calculations, which reduce the risk of miscalculations that could lead to penalties or delays.

Moreover, these tools can store and organize financial records and documentation securely, making it easier to retrieve necessary information when needed.

Many tax software solutions also come with built-in reminders and alerts for upcoming deadlines, ensuring that you stay on top of your filing schedule. Integrating such software into your financial management practices can enhance accuracy, save time, and ensure that your tax filings are done correctly and submitted on time.

Take deductions and credits legitimately

It is crucial to claim tax credits and deductions you are eligible for, but ensure that you do so legally.

Tax authorities can examine you more closely and impose penalties if you incorrectly claim credits or deductions.

Keep a backup plan

Despite your best initiatives, sometimes things go differently than scheduled. Having a backup plan is essential to reducing the effect of any unanticipated issues.

Keep a list of emergency contacts that you may contact in a pinch, such as a backup attorney or accountant.

In addition, be informed of alternative filing methods or extensions accessible for filing and know how to use them quickly if needed.

Final thoughts

It is necessary to understand the complicated tax landscape before diving into the practical side of things.

When dealing with Corporate Tax, businesses should consult expert tax advising services that will assist them in avoiding any potential penalties. However, by following the tips mentioned in the blog, you can easily navigate tax structure in the UAE.

Also, it is advised that before you file a tax return, you should get more information about corporation tax law and prepare your tax strategies accordingly.