Accounting and auditing are important for every single business.

Whether your company is new or well-established, managing your finances is crucial for growth and success.

That’s where bookkeeping and accounting services come into the picture.

These services do more than just crunch numbers—they provide valuable insights into your business’s financial health, help you comply with tax regulations, and support strategic planning.

In this blog, we shall explore why accounting and bookkeeping services are important for companies of all sizes and how they contribute to effective decision-making.

.

Key Takeaways

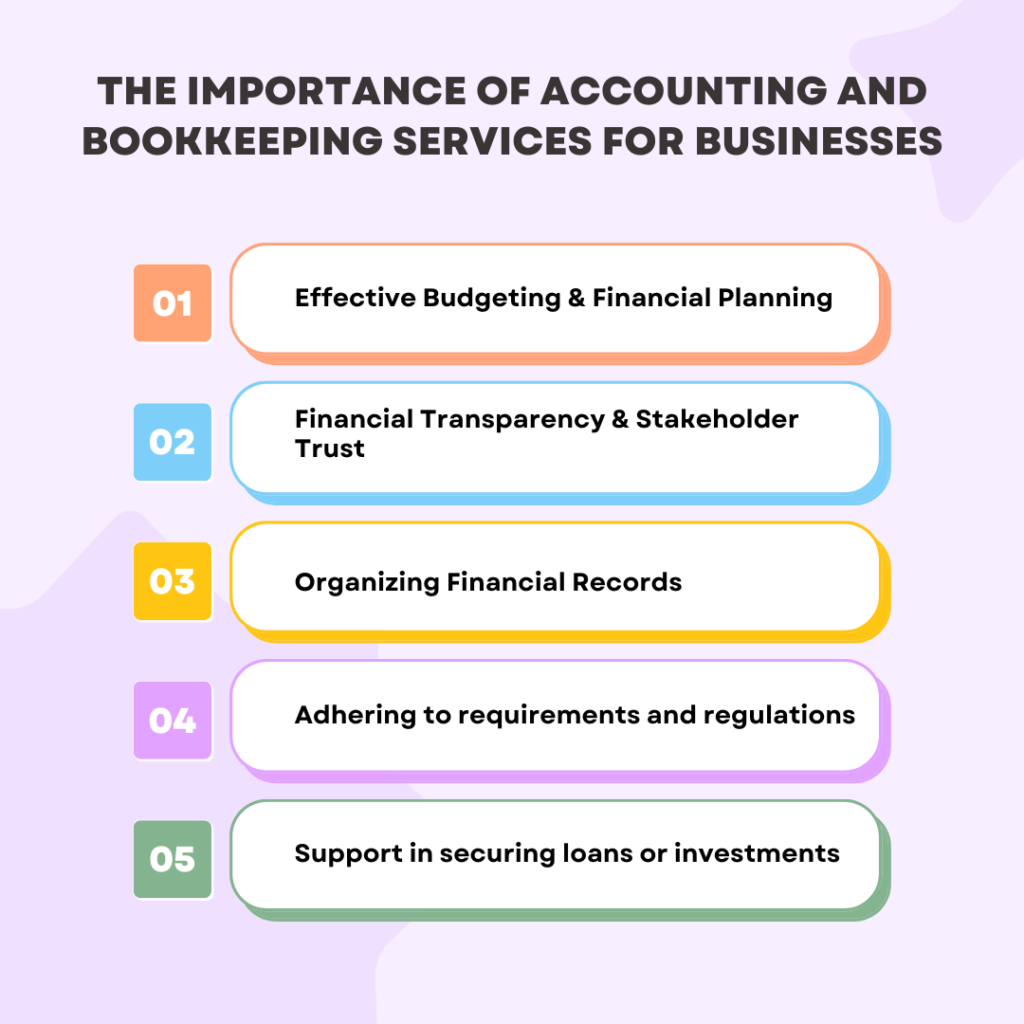

- Accounting and bookkeeping services offer vital financial insights, ensure tax compliance, and support strategic planning for businesses of all sizes.

- Organized financial records enable effective budgeting, build stakeholder trust, and simplify securing loans or investments.

- The choice between in-house or outsourced accounting depends on company needs, balancing cost, control, and task complexity.

The Importance of Accounting and Bookkeeping Services for Businesses

Effective Budgeting & Financial Planning

Accounting and bookkeeping help organizations budget and plan effectively.

It gives companies access to historical financial data, which they can use to assess prior performance and identify expenditure trends. Having this historical background is essential to developing data-driven, practical budgeting.

Additionally, it guarantees that companies have an accurate view of their financial situation, including cash flow, outstanding debt, and available assets.

This makes setting realistic financial goals and well-informed financial decisions easier.

Moreover, precise financial documentation facilitates the tracking of budget variables.

It also helps to keep things on monitoring by highlighting differences between real and planned spending.

Furthermore, this facilitates long-term financial preparation by forecasting future costs and industry patterns.

Bookkeeping and accounting enable organizations to create, track, and adjust budgets and financial plans, ensuring financial security, growth, and resilience.

Financial Transparency & Stakeholder Trust

Bookkeeping and accounting is essential for managing finances and building stakeholder trust in an organization.

It offers a precise and thorough overview of a business’s financial operations, highlighting sources of income, specifics of expenses, and asset management.

As a result of their ability to evaluate the company’s integrity and financial health confidently, stakeholders such as lenders, investors, and shareholders are encouraged to have faith in the business.

It also offers consistent and clear financial reporting, such as blankets and income statements.

These reports offer stakeholders insights into the business’s stability and profitability, emphasizing transparency.

Precise financial records also make it simpler to comply with rules and tax legislation.

By upholding legal requirements, this commitment reduces legal risks.

Additionally, open bookkeeping and accounting methods build client trust by demonstrating a dedication to ethical and moral financial transactions.

Organizing Financial Records

Keeping financial data organized is an essential component of any profitable company. It assists you in keeping tabs on all of your financial transactions, guaranteeing that everything is accurate and updated.

Some common benefits of maintaining structured financial records include:

- Financial information is easier to obtain when needed

- Simple and quick financial statement and tax return preparation

- Comprehensive understanding of financial health and business performance

Adhering to requirements and regulations

Running a business costs money and takes time. Nothing is more negative than having issues with the government, which may result in fines, tax audits, or worse.

As businesses expand, tax reporting becomes more complex and time-consuming as it includes payroll and P&L statements, among other things.

The bookkeeping and accounting services can help you avoid such difficulties since they have a thorough understanding of the tax rules and processes in the country.

Their experience enables them to discover inconsistencies immediately and ensure that your accounting records are without errors, allowing you to remain compliant.

Support in securing loans or investments

Accounting and bookkeeping services are crucial for businesses when securing loans or investments because they provide accurate and comprehensive financial statements, such as balance sheets, income statements, and cash flow statements, which are essential for demonstrating the company’s financial stability.

These services also help prepare financial projections and budgets, offering insights into future growth potential and break-even points, which are critical for investors and lenders.

By maintaining audit-ready financial records and ensuring transparency, these services build credibility and trust with financial institutions. They streamline the loan or investment application process by ensuring all necessary documentation is complete and accurate and by facilitating communication with lenders and investors.

Additionally, accounting services assist in identifying and mitigating financial risks, supporting a thorough due diligence process, and helping to accurately value the business, all of which increase the likelihood of securing the necessary capital.

When should you hire a bookkeeper and accountant?

Struggling to keep up with financial tasks

You may have sufficient time to handle the accounting processes in the early days of operation. However, success can swiftly change your circumstances, and you might have fewer free hours, setting back your accounting duties.

A qualified financial specialist handles your financial affairs, saving you time and money while you manage other business activities.

Growth in Sales and Revenue

If you’ve noted a rise in sales and revenue, it’s probable time to recruit a bookkeeper or accounting professional. You’ve got additional goods to sell, and want to maintain your financial information up-to-date while you hustle to expand the company. They’ll track every transaction quickly, so you can see which goods or services bring in the most wealth.

3. Unpredictable cash flow

Things occasionally slip between the cracks when work gets busy. Bills can be left unpaid, and invoices go unaccounted for. This results in outdated financial records and statements, which can lead to unpredictability in company cash flows. Hiring an accountant can assist in eliminating the issue and enable you to concentrate on other tasks.

They can remain on top of the transactions and make sure your financial records are in order. When your financial duties are incorrect, you are not aware of the actual situation with the company’s revenue. Unpredictable cash flow can lead to setbacks and make it very difficult to assess how your organization is performing.

4. Declining Profits

When you fail to achieve the profits you expected, it’s enticing to simply concentrate on working more diligently and selling more. But possibly the numbers are telling an entirely different story. Financial specialists can assist you in monitoring your company’s health by assisting with reducing operating costs, maximizing cash flow, and identifying trends and issues.

5. Tax season unpreparedness

Getting ready for tax season is important, without leaving anything for the last minute. Giving everything to the accounting professional to deal with shortly before taxes are due isn’t a wise utilization of anyone’s time.

Without a system in place for keeping track of your books, an accounting professional must have ample time to set up everything. To ensure that your company is prepared for taxes, they can assist you with tax preparation all year long.

They can also assist you with any retroactive accounting your company may require in addition to helping you with your current business taxes.

Outsourcing vs. In-House Accounting

Selecting between in-house and outsourced accounting is essential.

It can bring a major difference on the company’s financial stability and operational efficiency. 37% of small firms, according to studies, outsource bookkeeping and accounting services.

Below mentioned are few of the pros and cons of each:

Pros of In-House Accounting & Bookkeeping

- With in-house accounting professionals, you can regulate how much time they spend on every job because it’s simpler to interact with them than it would be with someone from a different company.

- It’s easier to build a relationship with in-house accounting professionals. You can form a trustworthy connection as you get to know your financial expert.

- In-house teams enable quick decision-making and immediate responses to financial issues.

Cons of In-House Accounting & Bookkeeping

- You’ll frequently face higher operational expenses such as paying the wages and perks of your accountants.

- Your team will be concentrating on prepping books, not on discovering new technology to enhance the existing process.

Pros of Outsourced Accounting & Bookkeeping

- The positive aspect of outsourcing is that you have an array of accounting solutions available to select from, such as payroll planning, compliance and taxation preparations, general bookkeeping and accounting.

- You save time. You have less work to do when you use outsourced accounting for retail establishments, construction bookkeeping services, or other industries.

- It costs less. If you outsource your solution, you can save money on thorough, in-depth accounting services, such as tax preparation accounting, and bookkeeping for restaurants, corporate or for auto repair shops, etc.

Cons of Outsourced Accounting of & Bookkeeping

- A significant disadvantage is a possible loss of control over the accounting procedure. Businesses may face difficulties when tracking and managing the outsourced team, resulting in concerns about data privacy and security.

- Relying on outside organizations for critical financial duties can pose risks. Any interruption or dissatisfaction with the outsourcing partner could directly affect the financial management of the company.

Outsourcing accounting is cost-effective and adaptive but may reduce control and raise security issues. For businesses with intricate financial requirements, internal accounting is a superior option since it provides greater control and personal attention. Ultimately, the decision depends on the company’s specific requirements.

Final thoughts

Bookkeeping and accounting are the lifeblood of any thriving organization. They offer financial stability, assist firms in setting and meeting their goals, and ensure that taxes are paid on time.

While businesses tend to minimize revenue by ignoring these services, it is unethical and inefficient to make shortcuts when it comes to skilled bookkeeping and accounting. Prioritizing accurate financial management is necessary for any business aiming to thrive.