Understanding the significance of a Tax Registration Number (TRN) is essential for companies operating in the UAE, especially those registered for VAT.

It ensures adherence to UAE tax regulations by acting as an official identifier for tax transactions.

This number is vital to the UAE’s taxation system as it is used in tax payments, official tax filings, and government transactions.

As an entrepreneur, you might be thinking about what this Tax registration number in UAE indicates or how important it is.

This guide will walk you through everything businesses need to understand about TRN in the UAE, such as its significance, application process, and common challenges.

Key Takeaways

- A TRN in the UAE, issued by the FTA, ensures VAT compliance and proper tax filings.

- Businesses must meet eligibility criteria, submit required documents, and apply online while maintaining accurate records.

- Avoiding errors like incomplete forms and incorrect details is crucial to prevent delays or rejection.

What is the TRN in the UAE?

The UAE Federal Tax Authority (FTA) issues TRN, an identification number that indicates companies and individuals who are registered to pay tax in the UAE. This number acts as an essential tool for the FTA to distinguish and manage taxpayers, ensuring adherence to the UAE’s tax regulations. The TRN is used in all tax-related transactions, submissions, and correspondence, like VAT return filings, tax statements, and tax credit notes. Businesses that have more taxable supply than the registration level are required to get a TRN, which they must then provide on all tax invoices and financial records.

The TRN not only simplifies tax compliance but also authorizes companies to charge VAT to their customers, thereby playing a significant part in the UAE’s tax system.

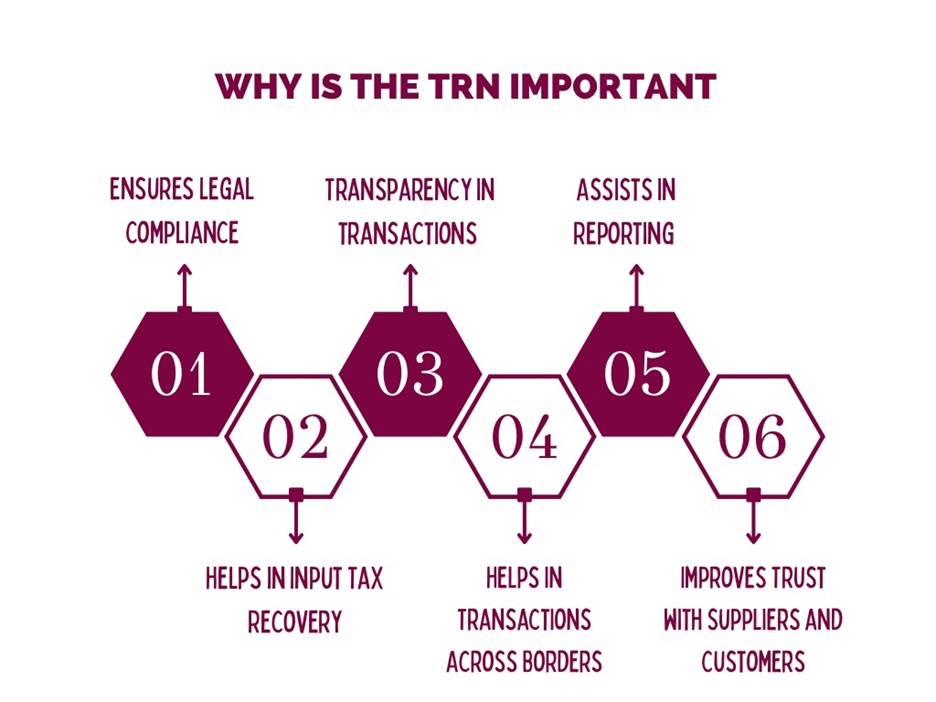

Why is the TRN Important?

The implementation of the TRN has brought about major shifts in the UAE’s business environment. Here is why the TRN is important to companies operating in the UAE:

Ensures Legal Compliance

Businesses that are VAT-registered are legally obligated to include their TRN on all official communications, invoices, and documents on taxable transactions.

The FTA can impose penalties and fines for failure to produce a valid TRN.

Helps in Input Tax Recovery

Companies can claim input tax credits on transactions only if they have a valid TRN. Verifying the TRN of suppliers ensures that a company is working with trustworthy suppliers and is able to recover input tax under VAT laws.

Transparency in transactions

The TRN encourages transparency between companies by ensuring both parties adhere to VAT regulations. Including the TRN on payments helps prevent miscommunication regarding VAT liabilities.

Helps in Transactions Across Borders

The TRN is necessary to guarantee correct VAT treatment for overseas transactions, particularly those that are zero-rated or exempt. Including the TRN in documentation assists in preventing tax authority inquiries and compliance concerns.

Assists in Reporting

Companies with a TRN follow a planned record-keeping and better accounting practices. They create structured financial management systems since they are required to track input and output VAT and issue compliant invoices.

Improves Trust with Suppliers and Customers

Companies that have a valid TRN show that they are reliable and competent. Clients are more likely to engage with businesses that follow tax regulations, as it ensures that they get valid tax invoices. Similarly, vendors prefer to collaborate with compliant companies to maintain their own VAT recovery processes.

What are the Requirements for VAT Registration and Obtaining a TRN in the UAE?

In the United Arab Emirates, not all businesses must register for VAT and acquire a Tax Registration Number (TRN).

The Federal Tax Authority (FTA) established particular thresholds for deciding whether VAT registration is mandatory or voluntary for an organization. Understanding these requirements ensures that your company remains compliant and prevents penalties.

Here’s what you should know about the eligibility requirements:

Mandatory registration

If a company’s taxable supplies and imports total more than AED 375,000 in the previous 12 months, they must register for VAT and get a TRN. They are also required to get a TRN if they expect taxable goods and imports to go above AED 375,000 in the next 30 days.

Voluntary registration

Organizations have the option to register for VAT and get a TRN if, in the last 12 months,their taxable imports and supplies total more than AED 187,500 but less than AED 375,000. Also, if they expect that their expenditure exceeds AED 187,500, they may be qualified to reclaim VAT on purchases.

Exempt from registration

Companies with taxable supplies under AED 187,500 are exempt from obtaining a TRN or registering for VAT.

Documents Required for TRN (Tax Registration Number) in the UAE

To get a TRN number in the United Arab Emirates for your company, you need to submit all the required paperwork to the concerned divisions. You can also obtain the TRN number from Dubai, in the United Arab Emirates, by working with a reputable and knowledgeable tax expert from a company.

Below is a list of documents you may need to submit:

- Company trade license

- Passport copies of shareholders and managers

- Import or export declarations

- Emirates IDs of shareholders and managers

- Sample invoices from suppliers and customers

- Company turnover declaration letter

- Income statement from the previous year

- Memorandum of Association (MoA) of the company

- Company contact information and address

- Company bank account details

How to apply for a TRN in the UAE?

To apply online for a tax registration number, follow these steps:

Step 1: Register on the FTA Portal

You must first create an account on the Federal Tax Authority (FTA) website:

- Check out www.tax.gov.ae.

- Select “Register.”

- Choose a password and enter your email address.

- Check your email to verify the account

Step 2: Complete the TRN Application

Go to the TRN section after logging onto your FTA account. Carefully, enter your company’s necessary information.

Step 3: Add Documents

Include scanned copies of your passport, trade license, and any other paperwork required to process your application.

Step 4: Pay Application Fee

After adding documents, make a payment of AED 100 fee online via debit/credit card.

Step 5: Receive TRN Certificate

Within 15 to 20 business days of approval, you will receive an email with the TRN certificate.

Common Obstacles and Mistakes to Avoid

Although applying for a Tax Registration Number (TRN) can be simple, businesses frequently encounter obstacles that cause the application to be delayed or rejected. You can avoid wasting time and stress by being aware of these typical errors.

Submitting incomplete applications

Please make sure you complete the VAT registration form by filling out all the required fields. Missing information can lead to mistakes and rejections.

Providing inaccurate information

Double-check company details, like turnover figures, license and permit numbers, and financial data, to ensure precision. Approval may be delayed if these fields include errors.

Neglecting proper record-keeping

Keep thorough records of all financial transactions and the paperwork you need to register for VAT. Inadequate documentation might lead to issues during audits or application reviews.

Using an Invalid or Incorrect Trade License

The business trade license needs to be current and correspond with the information on the TRN application. Expired or incorrectly classified trade licenses can lead to disapproval.

Not Checking the TRN of Suppliers or Clients

To correctly claim VAT refunds, businesses must confirm the TRN of their clients and suppliers. Financial penalties and compliance problems may arise from using a fake or inaccurate TRN on tax invoices.

Frequently Asked Questions

How many numbers does a TRN Number contain?

The FTA of the United Arab Emirates issues the 15-digit TRN Number.

What happens if I submit my TRN application incorrectly?

To prevent being rejected, get in touch with the FTA call centre right away. Providing more documents might assist rectify information for small errors.

Should I register several TRNs if I have two companies?

Yes, in order to properly submit taxes, you need to register distinct TRNs for every corporation or business organization.

Final thoughts

Businesses doing business in the United Arab Emirates must have a Tax Registration Number (TRN) in order to comply with VAT regulations and facilitate easy tax administration. From registering under the FTA’s e-services portal to keeping precise invoices and filings, a TRN simplifies business operations while preventing VAT fraud.

Proper compliance with VAT regulations, such as timely TRN registration, is essential to prevent penalties and enhance authenticity in the UAE. By understanding the importance of TRN, businesses can confidently navigate the VAT system while contributing to a transparent, compliant financial system.