Value Added Tax (VAT) plays an important part in the Abu Dhabi economy, impacting companies across the entire nation.

Knowing and adhering to the VAT Late Payment Penalty is essential for any company in Abu Dhabi. Compliance keeps the business operating efficiently and assists them to avoid fines.

So, if you’re a company owner, a certified public accountant, or simply curious about VAT regulations in Abu Dhabi, this article is for you. Come along as we explore the world of VAT fines and penalties and learn what you must do to maintain compliance and save unnecessary expenses.

Registration for VAT in Abu Dhabi

Businesses in Abu Dhabi are required to register for VAT if their taxable imports and supplies amount to more than AED 375,000 per year.

There’s also a choice for voluntary registration if the overall value of supplies or expenditures exceeds AED 187,500.

Registering on time is essential for avoiding any penalty for late VAT submission in Abu Dhabi and ensuring uninterrupted company operations.

Late VAT payments can significantly affect an organization’s profits.

Thus, it may be a good idea to speak with a VAT specialist in Dubai.

They can assist businesses in meeting deadlines and adhering to VAT regulations, which will help them avoid late VAT payment penalties in Abu Dhabi.

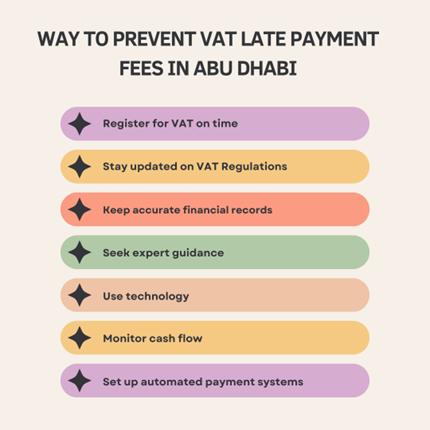

Way to prevent VAT late payment fees in Abu Dhabi

Register for VAT on time

When revenues reach the VAT filing limit, make sure to file promptly.

This involves complying with the regulations and registering for VAT at the appropriate time. Businesses can ensure compliance with the law and avoid penalties by promptly completing the VAT registration process within the required timeframe.

To ensure timely submission, prepare your VAT returns in advance.

Use reminders or applications for recalling important dates.

Avoiding late fees can be achieved by sending your returns on time.

Stay updated on VAT Regulations

Abu Dhabi’s VAT rules may be subject to modifications. Here’s how to keep businesses updated:

- The FTA website is a reliable source for the most recent VAT rules, announcements, and guidelines.

- Your tax consultant can inform businesses regarding any pertinent changes to VAT regulations.

Keep accurate financial records

Careful record-keeping is the cornerstone of timely VAT reporting and avoiding late payment penalties.

Keep track of every transaction along with any supporting records, such as invoices and receipts. This makes it possible to calculate VAT accurately.

Seek expert guidance

Think about collaborating with a VAT consultant or tax expert who is knowledgeable about Abu Dhabi tax laws. They can provide helpful assistance by:

- Helping businesses navigate the complexities of VAT compliance and guarantee that the filings are made on time.

- Their knowledge can guarantee compliance with VAT laws and assist businesses in navigating intricate transactions.

Use technology

All VAT-registered businesses are now required to utilize VAT-compatible software in order to maintain VAT records and submit their returns.

The software will simplify the procedure by performing tasks like calculations, creating VAT invoices and planning the returns.

Additionally, it will notify businesses when payments and refunds are due.

Monitor cash flow

Maintaining a steady and sufficient cash flow is essential to promptly fulfilling VAT obligations. Businesses should create a thorough budget to track their earnings and outlays, setting aside a certain percentage of their income to pay for VAT obligations.

Keeping a VAT reserve fund—a dedicated account in which the tax portion of the income is deposited—can assist businesses in preventing cash flow bottlenecks.

Additionally, proactive cash flow management enables them to handle unforeseen costs without affecting their capacity to make on-time VAT payments.

Set up automated payment systems

Delays in making VAT payments manually can lead to fines and consequences. Think about using online banking with pre-planned transfers or direct debit to set up automatic payments to the FTA.

Automating payments decreases the possibility of oversight and guarantees the VAT responsibilities are settled on time.

Automated systems can also send out reminders or notifications, which can ease executives’ minds so they can focus on other business-related tasks.

Conditions under which Abu Dhabi companies may be subject to VAT penalties

Neglecting Records

According to the Federal Tax Authority’s regulations, companies operating in Abu Dhabi are required to maintain accurate records of their activities and possess the necessary paperwork.

VAT fines and penalties of AED 10,000 for a first offence and AED 20,000 for a repeat offence may be imposed for failing to provide these papers during a tax audit.

Failure to Provide Tax Credit Invoice

The vendor has to send a valid tax credit invoice to the consumer, who is liable for settling the VAT.

Failure to send out the invoice can result in VAT penalties and fines of AED 2,500 for each incorrect paperwork.

Incorrect tax return submissions

Errors in tax return proposals may additionally give rise to fines.

S ubmitting an incorrect tax return incurs a penalty of AED 1,000 for the first instance and AED 2,000 for any subsequent errors.

Late submission of VAT returns

Companies must submit their VAT returns on time. Inability to do so faces a fine of AED 1,000 for the initial offence and AED 2,000 for subsequent offences within 24 months.

Engaging in Tax Evasion

Penalties can be harsh if a company is shown to be purposefully avoiding VAT payments or participating in fraudulent actions (such as creating false records or tax avoidance schemes).

Depending on how serious the offence was, the penalty could range from 50% to 300% of the unpaid tax amount.

Not Updating FTA on Changes

A company may be penalized if it makes any major changes without notifying the FTA, such as changing its address, ownership, or organizational structure. For the first offence, the penalty is AED 1,000; for subsequent offences, it is AED 2,000.

Not filing for VAT

Companies that are required to register for VAT but choose not to do so risk fines or legal issues for breaking the regulations.

To avoid these fines, it is crucial for companies to understand and adhere to VAT regulations.

FAQs

1.Can VAT Penalties In Abu Dhabi Be Appealed?

In Abu Dhabi, companies are able to appeal VAT penalties.

Within 20 business days of the penalty notification date, a reconsideration request must be sent to the FTA. Make sure you include all the supporting paperwork and a concise justification for the appeal to improve your chances of a favourable result.

2. Does Abu Dhabi have any exemptions from VAT late payment penalties?

At present, there are no standard exceptions for VAT late payment penalties in Abu Dhabi.

To avoid fines, all taxable individuals must abide by the VAT rules and make sure that their payments are made on time.

If there are extraordinary circumstances, businesses may argue their case before the FTA, but there is no assurance that they will be excused.

3. What Are Abu Dhabi’s Late VAT Payment Penalties?

In Abu Dhabi, the VAT Late Payment Penalty can be significant.

As soon as the payment deadline passes, you will first be subject to a 2% penalty on the outstanding tax balance. A 4% monthly penalty is levied after the first month.

After one calendar month, this penalty keeps growing at a rate of 1% every day, reaching 300% of the outstanding tax. To avoid these fines, it is essential to ensure VAT compliance in Abu Dhabi.

Final Thoughts

Failing to meet VAT obligations or delaying VAT payments and reporting can lead to significant fines, despite the challenges of managing complex tax filing requirements.

Therefore, it is essential to ensure that businesses take every necessary action to fill in their returns and transactions on time and accurately in order to avoid any penalties.

By following the tips provided in this article, businesses can minimize the risk of consequences and ensure their tax returns are up-to-date.